What are Applicable Federal Rates (AFR) for December 2025?

AFR rates are minimum interest rates set by the IRS for private loans to avoid tax implications. These rates are published monthly and vary by loan term. Family loans, intra-family loans, and private lending arrangements must use at least the AFR rate to avoid gift tax consequences. Learn more about AFR

AFR Rate Categories for December 2025

Rate ranges reflect different compounding periods (monthly to annual). ℹ️ Why different rates?

December 2025 AFR Loan Payment Calculator

💡 Ready to calculate! Default values are loaded - click "Calculate Payment" to see results, or adjust the amounts below.

📝 Need to use a custom interest rate? Use our Basic Loan Calculator instead.

Free Loan Document Templates

Professional templates for loan agreements and payment tracking - no signup required!

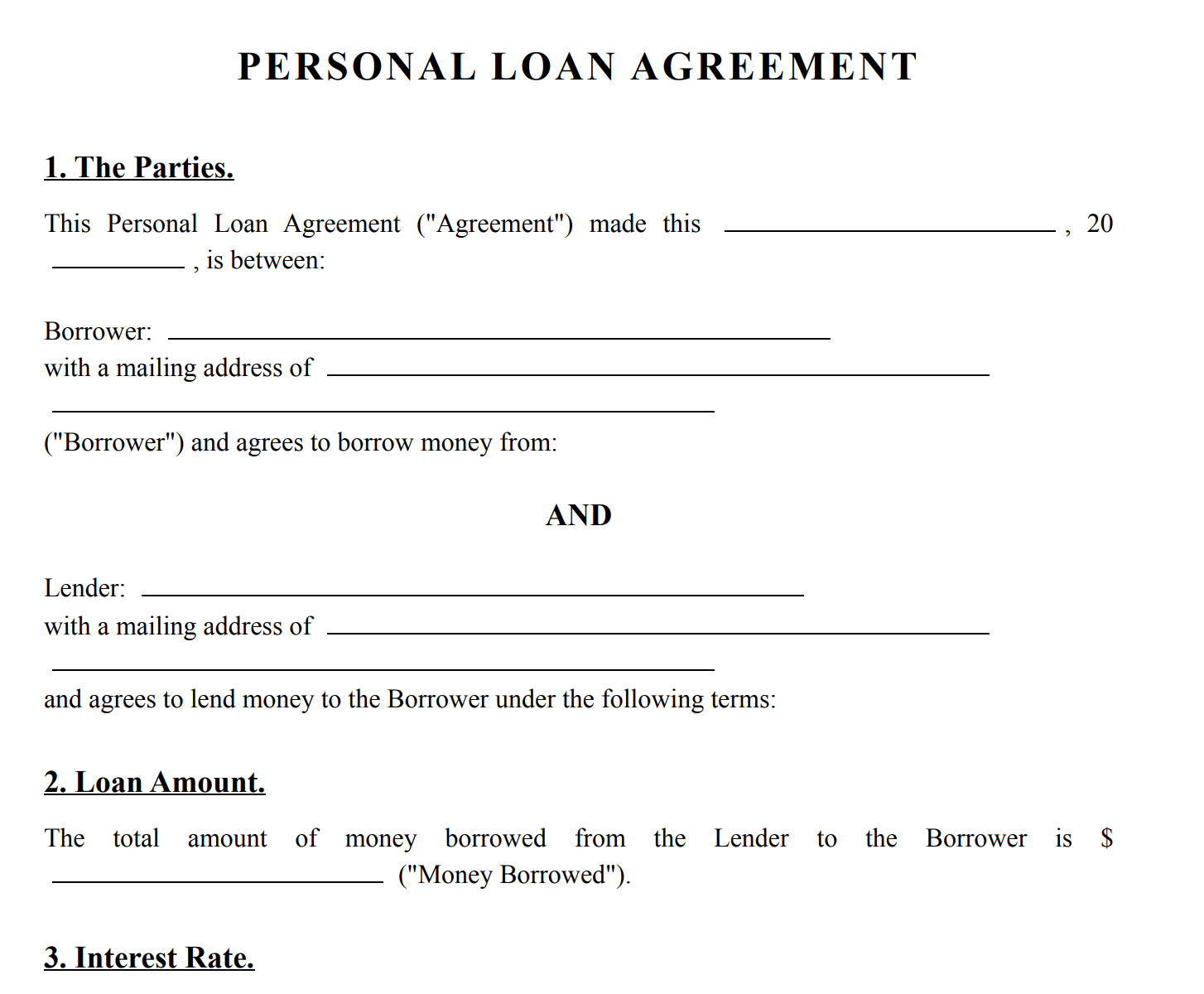

Personal Loan Agreement

Professional loan agreement with AFR compliance provisions and legal protections.

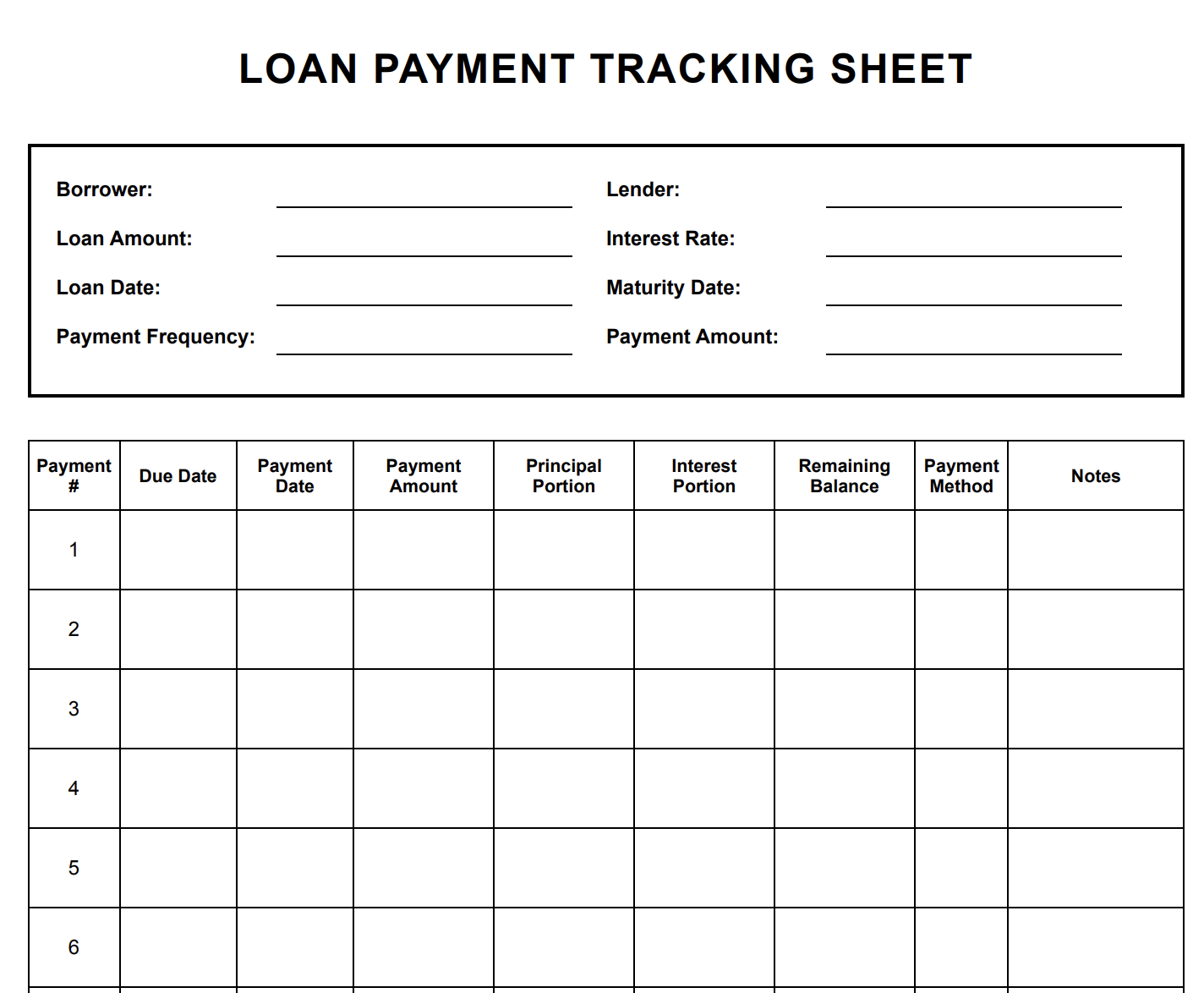

Payment Tracking Sheet

Track loan payments with this comprehensive spreadsheet template for record keeping.

Need more than templates? Our app automates everything!

Try the Full App Free →Frequently Asked Questions - December 2025 AFR Rates

When do I need to use AFR rates?

AFR rates must be used for private loans between family members, business partners, or any non-commercial lending arrangement to avoid gift tax implications. The IRS requires loans to charge at least the AFR rate to be considered legitimate debt rather than a gift.

How often do AFR rates change?

The IRS publishes new AFR rates monthly, typically in the last week of each month for the following month. Our calculator is updated with the December 2025 rates from IRS Revenue Ruling 2025-24. Rates are based on average market yields of outstanding marketable obligations of the United States with varying periods to maturity.

Can I use a rate lower than the AFR?

No, using a rate below the AFR can result in the loan being treated as a gift by the IRS. This could trigger gift tax consequences for the lender and imputed income for the borrower. Always use at least the minimum AFR rate for your loan term.

What's the difference between AFR categories?

AFR rates are categorized by loan term: short-term (3 years or less), mid-term (over 3 to 9 years), and long-term (over 9 years). Longer-term loans typically have higher AFR rates to account for increased risk over time.

Benefits of Using Our December 2025 AFR Calculator

🎯 Accurate Calculations

Always updated with the latest IRS-published AFR rates - currently featuring December 2025 rates for precise loan payment calculations.

📊 Multiple Compounding Options

Calculate payments for monthly, quarterly, semiannual, or annual compounding periods.

⚡ Instant Results

Get immediate calculations for family loans, business loans, and private lending arrangements.

📱 Mobile Friendly

Access the calculator from any device - desktop, tablet, or smartphone.

December 2025 AFR Loan Calculator Summary

Our December 2025 AFR loan calculator helps you determine monthly payments for private loans using the latest IRS Applicable Federal Rates for December 2025. Whether you're setting up a family loan, intra-family mortgage, or business loan arrangement, this tool ensures compliance with IRS requirements while providing accurate payment schedules based on the most current rates.

The calculator automatically selects the appropriate AFR category based on your loan term and applies the correct rate for your chosen compounding frequency. This eliminates guesswork and ensures your loan meets federal tax requirements.

Key Features: Current December 2025 AFR rates, automatic rate selection, multiple compounding options, instant calculations, and mobile-responsive design. Perfect for estate planning, family financial arrangements, and business lending scenarios.